Having a corporate background as a business analyst and pricing manager, I know how important it is to know your numbers. From knowing if your business is making a profit and if your services are making a profit to having a yearly financial budget and keeping track of where you are in terms of revenue compared to your budget so that you can take action if need be.

But what if you’re a designer who rather clean their bathroom with a toothbrush than look at the financial side of your business? And I get it! We all have elements within our business that we don’t feel comfortable with. For creatives, this is usually the ‘business side’ of running a design studio like keeping track of the financials or setting up workflows and client management systems.

At one stage you’ve probably tried doing this, failed at it (or at least that is what you tell yourself) and then kept yourself so busy with designing logos or mocking up websites for clients because that’s what you feel comfortable with, that there was never enough time to do the uncomfortable work. But when you want to create a sustainable business you need to know the numbers at which your design studio is sustainable. Or at which income you can get rid of a retainer client?

Because how else do you know what you’re actually working towards? And if you don’t know this, a sustainable design studio just stays an idea that doesn’t get executed.

So let’s look at 4 key pieces of your finance routine you need to get comfortable with so that you can determine what a sustainable design studio looks like for you.In this blog, we’ll get into:

- Financial insights for your Design Studio – The big picture

- Financial key piece your Design Studio needs 1: Revenue budget

- Financial key piece your Design Studio needs 2: Expense Overview

- Financial key piece your Design Studio needs 3: Revenue Overview

- Financial key piece your Design Studio needs 4: Sales Overview

The big picture

There’s a lot that goes into getting an accurate financial overview of your business. I believe you can not do this without looking at your personal finances so that you can determine what you need to contribute with your business to your household expenses. But this also includes things like income tax etc and not only would this be too much to talk about in one newsletter, but I am also not a financial advisor so I will keep it to the big picture.

So what does this big picture work look like? When I tell coaching clients I would like them to track all of their time or ask if they know how many hours a week they work while talking about their revenue or profit, I often get a bit of a puzzled look and they wonder how these things relate to each other.

And it might be the same for you.

You’ve probably been told you need to track your time but not been explained how this small thing forms the base for financial decisions like your pricing, how you can schedule your week with time blocks and how to use this to not overcommit and be constantly overworked. I am not a fan of doing things for the sake of doing them. For everything I do in my business, I want it to be part of a bigger picture. I want it to help me come closer to achieving my goals. So if I mention something like time tracking, you can be sure that it has a purpose.

What do you need to have a clear picture of within your business that you will need:

- How you are spending your time each week (yes, you need to time track everything you do) because you want to know how many hours per week you spend on client work and how many hours on the back-end of your business so that you can make sure you’re also getting paid when you don’t work on client projects.

- Your ideal workweek for your current phase in business so you know how many hours you work per week (created with the help of the above point) and know how much capacity you have for client work while still keeping space to work on your business (more on this below)

- Your monthly and yearly expenses to run your business

So that you can create

- A yearly revenue budget (based on this-is-enough-for-me targets)

- Monthly revenue targets (based on the annual budget) so that you can gauge how realistic your revenue target is

- An overview of how many times you need to sell your services to reach your annual budget to test how realistic your revenue target is. And if you even have the capacity to offer this many services in a year.

- An overview of your expected profit. For the business in general and per service

- Savings targets so that you can put aside some money each month to save up for your expenses and investments for the next year

And set up tools to keep track of

- How much revenue you have made this year so far?

- How much money is supposed to come in based on your current contracts?

- How many times do you need to sell your services for the rest of the year to hit your revenue targets?

- How much profit you have made this year so far?

This is a lot, I know. And I’m not trying to scare you off. But there might be some things on these lists that you’ve never thought of or that you’ve tried in the past but didn’t work for you as a designer or things that are so far out of your comfort zone that you’ve never tried them. And that’s why I am bringing this up. Now let’s jump into the first key piece of your finance routine: a revenue budget

Financial key piece 1: Revenue budget

The most important thing when it comes to creating a budget is that you do this based on your ‘enough’.

- Not your business buddy’s enough…

- Not your competitors enough…

- Not 6-figures just because we’re led to believe this is somehow the holy grail.

What is your enough?

Ask yourself this. What $/£/€ amount do you need to earn with your business that is enough for you to live comfortably and that will keep you motivated and not burned out? Side note ➝ Learn from Vanessa Lau what not to do. She built a 7-figure business and had to burn it all down as her business and herself had turned into something she never wanted. If you know this, you can put a plan in place to get you there. But if you don’t and all you want is more, more, more and you try to keep up with others and feel pressured to aim for the same goals (even when you’re in a completely different phase in business) all you do is set yourself up to fail.

Because before you know it, you’re halfway through the year and you’re not even close to those huge goals you set for yourself. The result? Your motivation is gone (been there, done that) and the confidence you had in yourself to transform your design studio to be more profitable and sustainable got a big hit. But what do you do with this number? Because it is one thing to come up with this enough number based on what you want your contribution to be to the household expenses, it’s another to gauge if this is a realistic number, which leads me to the next step.

How realistic is your revenue budget?

One of the things I often work through with clients is determining their capacity and working based on this capacity. What this means is having a clear picture of:

- How many hours per week you want to work (your capacity)

- How much time in hours it takes to complete each of your services

- What needs to happen within each week of your client projects (week 1 = creative direction, week 2 = first concepts etc) and how it takes you to complete each of these phases.

This will allow you to create a weekly schedule and only plan the work (and hours) that fit within that week. I’m sharing more about how I plan my week here and why I stopped using a to-do list here. The benefit of working this way?

- You’ll overcommit less: Because you know exactly how long a task will take if you track your time (and adjust your time estimates based on your learning) you’ll learn how many client projects can you take on at the same time. Add to that a clearly defined timeline for your projects you’ll be able to plan your week based on your capacity.

- You’ll feel like you have finished everything you needed to by the end of the week.

- It will also allow you to gauge if the revenue target that you have set yourself is realistic.

Something I have noticed is that often there is a big gap between the want and the need.

What I mean by this is, that the need is the revenue that is needed to cover the costs of the business for the full year (I’ll get into this more in key piece 2), the contribution to the household expenses (regardless if you are solely responsible, mainly or have a set figure to contribute) and business savings pot as a reserve.

The want is often a revenue target that is based on what we feel we should make by now or because it is what you used to make before starting your own business.

And I am absolutely not saying that you should not have big goals, you should! But what I want you to look at is how realistic the revenue target is based on:

- The revenue you are making now and how big the jump is,

- The time that you have to work on client projects as well as on your business (your capacity) because you will need to be able to do the work,

- Tour infrastructure (business processes, systems, client workflows) and if the current setup would allow for more clients

So that you can set yourself up for success, not failure.

Want to know how to increase your revenue without adding more clients? Read this article

Financial key piece 2: Expense Overview

Revenue is one thing, but just because you earn money, does not mean that you’re also making a profit. I think making a profit is often seen as a big-picture thing. If you make more money than what goes out you’re making a profit. Which technically is true.

When it comes to the cost of doing business a lot of your expenses will be related to software like Photoshop and Illustrator, website hosting, client management systems like Dubsado or Honeybook, project management systems like ClickUp and software like Quickbooks. But this also includes any costs for contractors, coaching and any marketing activities. And don’t forget to include processing fees from payment processors like Paypal.

When you’re creating an expense overview you want to:

- Know how much your expenses are for the full year

- What your expenses for each month are.

Once you know your expenses you can deduct these from your revenue target to calculate your estimated profit. I know this is not the full calculation as you’ll also need to consider your owner’s draw (your monthly contribution to the household expenses) and setting money aside for federal and state tax if you’re in the US or the income tax percentage of your country. I won’t go into detail on how to do this as this will look different for everyone but I highly recommend reading Profit First from Mike Michalowicz*.

Because the cost of running a business is relatively low, most businesses will run at a profit. But as a design studio, you also need to take the hours you work into consideration when thinking about expenses. While your business may be profitable, your services might not be.

How does this happen? When you’re paid $2k for a client project, your hourly rate is $50 and you spend 50 hours on your project, your service is not profitable.

When you spend 50 hours * $50 hourly rate = $2,500 <- your cost to deliver the service.

If you want to know more about how to calculate if your services are making a profit you can find more information about this in this article: How to price your design packages for profitability Or you can download the pricing workbook that helps you do this step-by-step.

Need a quick boost in your profit?

Is there somewhere you can cut down on your costs? Like paying your website hosting for the full year instead of per month. As a reward, you will often get a discount for paying for the full year and this can save you 1 to 2 monthly payments. Do you really need all of the software you’re using? Or can you manage with a cheaper plan?

Planning for a rainy day.

In the first section, I mentioned revenue target wants and needs. One of the things I touched on here was having a business savings pot as a reserve. When it comes to sustainability in a business I also like to consider the not-so-great situations and how you can prepare for them. Because let’s face it, there will be times you bring in fewer clients, you’re sick or you need to take care of someone else. All situations where your revenue will be impacted negatively.

The last thing you want at a time like that is to have to worry about being able to pay your expenses. So when possible, set some money aside in a savings pot to cover your expenses. At first, you want to make sure you have saved enough to cover your expenses for the next 3 months. Then you can go on to save for all your expenses for the 6 months or even for next year (how great would it be going into the new year knowing all of it is covered).

Once you hit that savings goal, the next one is to save up for future investments.

Investing in your business is often quite hard because you have not saved for it. You might have been in a situation where you wanted to invest but needed the money in your account to pay for your business expenses; so you didn’t invest.

So let’s make this a part of your financial routine so that you can set yourself up for success.

Financial key piece 3: Revenue Overview

Once you have set your realistic revenue target and know exactly which expenses you have each month, it’s time to keep track of your revenue throughout the year. And no, this is not the same as using Quickbooks for accounting purposes. These systems only look backwards to money that has already been made or invoices that have been sent out. Using a revenue overview like this will allow you to proactively take action. As you’ll not only know what has come in but also what needs to come in, you’ll always have a clear insight if you’re off track to reach your budget. If not, you’ll need to look at your sales overview (mentioned below) to know which action you need to take.

In the below video, you can see how you can make a revenue overview in ClickUp and which elements you should include. In this blog, I will dive into this a bit more in detail.

Financial key piece 4: Sales Overview

Not all of your services are created equal. This might sound a little bit strange so let me explain. In general, you will see that you’re not selling each service the same number of times. So this also means that not all services have an equal impact on the total revenue and profit that you’re making. This in turn means, your focus on selling your services should also not be the same.

After you have set your revenue target for the year, you will need to determine how many times you need to sell each service to reach your revenue target. To do this you can make a list of your services and note how many times you sold each of your services so far. Then calculate what their contribution was to your overall revenue.

Let’s say you want to make £40.000 in revenue.

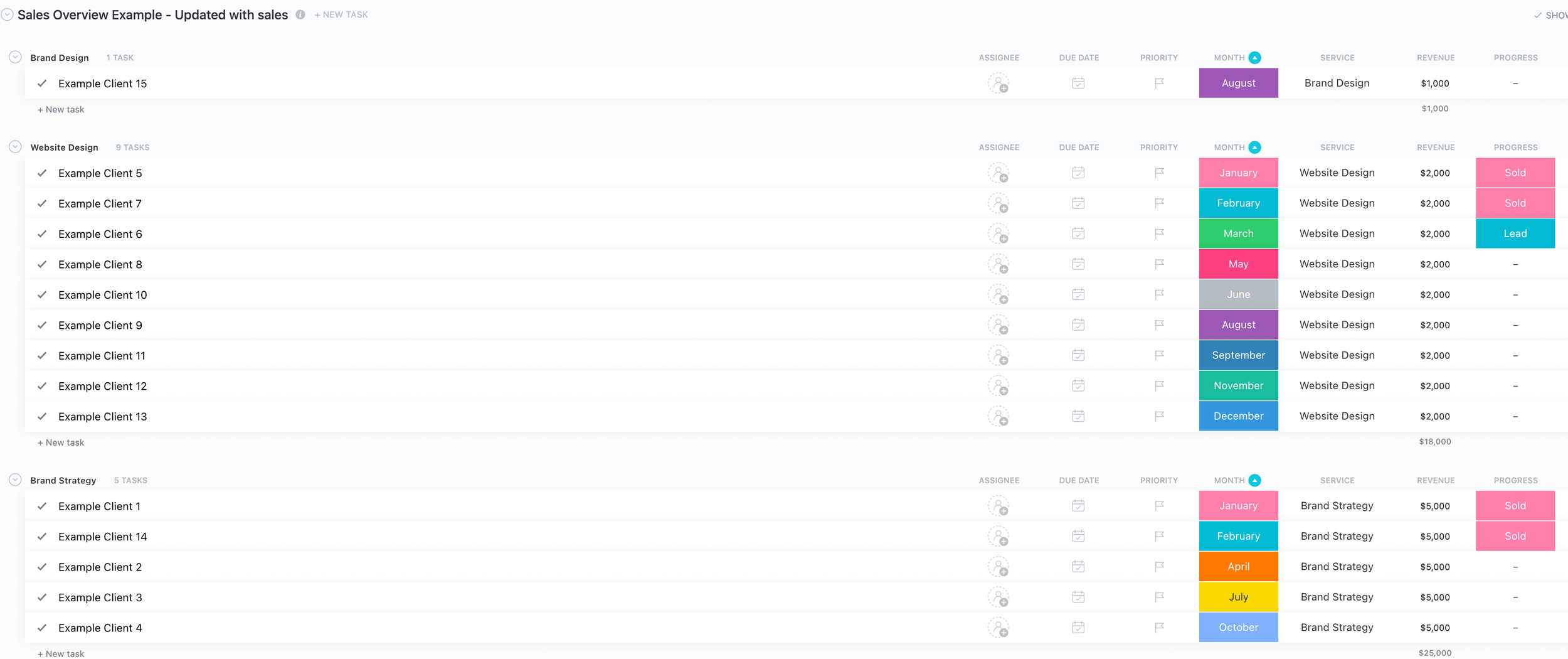

You offer 3 different design packages which you sell for £1.000, £2.000 and £5.000. You sell your middle package the most, which is generally 1 per month. Now you can calculate how many times you need to sell each service to get to £40.000. Now you know that you need to sell:

- package 1 -> 4x = £20.000 (brand strategy in below ClickUp Screenshot)

- package 2 -> 9x = £18.000 (website design in below ClickUp Screenshot)

- package 3 -> 2x = £2.000 (brand design in below ClickUp Screenshot)

- But this is just your starting point at the beginning of the year. As the year goes on, your sales might look quite different because sold option 1 more or offered custom packages. That’s why you need to keep track of how much you’ve sold of each service and update your overview to determine how many times you need to sell each service till the end of the year to hit your revenue target.

Here’s an example of how you could create a sales overview at the beginning of the year in ClickUp to reflect which design projects you need to sell.

Now let’s jump to February. You’ve just updated your actual sales and see that:

- You have sold more brand strategy projects than planned. You thought 1 per quarter as it is your highest-tier service. But you sold 1 in January and 1 in February.

- Your total forecasted revenue is now £45.000 instead of £40.000. You sold this earlier than expected, which makes it additional revenue.

While this would be a great result and more than your target revenue, you also want to be realistic as you still have another 9 months to go. So to compensate you remove 2 website design packages and 1 brand design from your sales target.

Now you know that for the rest of the year your marketing needs to focus on selling:

- package 1 -> 3x (brand strategy in below ClickUp Screenshot)

- package 2 -> 6x + convert 1 lead (website design in below ClickUp Screenshot)

- package 3 -> 1x (brand design in below ClickUp Screenshot)

Something I like to add to this overview for clarity is a dropdown (called custom field in ClickUp) that marks a design project as sold or if the project has a lead.

As you can see, there is much more that goes into this than just tracking your revenue or even just your financials because a thriving studio is not just about the money. It’s about finding a balance between the number of hours you work (with the help of business processes, systems and client workflows) and the financial result that this gives you.

But above all, you need to get comfortable with the tasks in your business that you’ve ignored.

These are the tasks that will make a difference. These are the processes that need to become a habit and part of your daily/weekly/monthly routine. As while it’s good to have a financial number to work towards, you don’t have full control over the result. But you do have full control over executing the processes needed to achieve the result.

This is what will allow you to be proactive when it comes to achieving your business goals instead of reactive and ‘just’ seeing at the end of the year where you ended up.

But to get to this stage, you need to do the uncomfortable work.